gazeta-dona.ru Overview

Overview

Where To Get A Loan With No Income

:max_bytes(150000):strip_icc()/how-to-get-personal-loans-with-no-income-verification-7153103-final-4a9099bdba6e4405a5615bc6cd0fd0a9.jpg)

A no income check mortgage also known as the no income verification mortgage is a mortgage program that allows individuals to get a mortgage without. A no doc mortgage loan in Florida is also called a no doc no income verification loan — essentially, it is a Non-QM loan, which allows you to obtain financing. Emergency loans with no job: Three Options If You Don't Qualify for a Personal Loan. · 1. Apply with a co-signer · 2. Get a joint personal loan · 3. Apply for a. What is an unsecured loan? Unsecured loans don't require collateral, such as a home, vehicle or savings account, to back the loan. Instead, they are backed. Since there's no collateral, financial institutions give out unsecured loans based in large part on your credit score, income and history of repaying past debts. You can get a loan while unemployed. However, it may be harder to qualify, and there are downsides to personal loans for unemployed individuals to consider. Getting a personal loan with no income verification is still a possibility, however. Lenders will simply have to look at other issues concerning the borrower. What is an unsecured loan? Unsecured loans don't require collateral, such as a home, vehicle or savings account, to back the loan. Instead, they are backed. Below we work through the nuances of no-income loans and how you may get a personal loan without income verification. A no income check mortgage also known as the no income verification mortgage is a mortgage program that allows individuals to get a mortgage without. A no doc mortgage loan in Florida is also called a no doc no income verification loan — essentially, it is a Non-QM loan, which allows you to obtain financing. Emergency loans with no job: Three Options If You Don't Qualify for a Personal Loan. · 1. Apply with a co-signer · 2. Get a joint personal loan · 3. Apply for a. What is an unsecured loan? Unsecured loans don't require collateral, such as a home, vehicle or savings account, to back the loan. Instead, they are backed. Since there's no collateral, financial institutions give out unsecured loans based in large part on your credit score, income and history of repaying past debts. You can get a loan while unemployed. However, it may be harder to qualify, and there are downsides to personal loans for unemployed individuals to consider. Getting a personal loan with no income verification is still a possibility, however. Lenders will simply have to look at other issues concerning the borrower. What is an unsecured loan? Unsecured loans don't require collateral, such as a home, vehicle or savings account, to back the loan. Instead, they are backed. Below we work through the nuances of no-income loans and how you may get a personal loan without income verification.

A no income verification mortgage is often referred to as a no doc mortgage as the name implies, this type of loan does not require the lender to verify how. No-income loans allow you to take out a loan for a primary residence without having an income or without showing taxable income on your tax returns. Normally. This article describes personal, auto, and home loans available to low-wage earners and folks on modest fixed incomes. OppLoans online loan platform offers installment loans to middle-income consumers, who may have bad credit or no credit. Here is additional information for. I have heard Uber or Lyft offer some options for car financing for employees. Try looking into this. But you will have to carry insurance. Get a loan quickly even with no credit history. Fixed, affordable income, the potential for rollovers and refinancings, and legal parameters. Personal loans for low income · Upstart has one of the lowest available APRs of Credible partner lenders and of all non-partners we reviewed, making it a good. While finding title loans without proof of income will be challenging, that doesn't mean you need a specific type of job to qualify for an auto title loan. A No-Ratio DSCR loan is a type of mortgage that allows us to approve your loan without verification of your income. Basically, it's a “potential rental income. Best lenders that offer no-credit loans · Earnin — If you're employed, Earnin may be a good choice for a small amount to tide you over until your next check. A no-income-no-asset (NINA) loan is a specialized type of mortgage loan program. With this loan type, the borrower can be approved without the standard income. Thankfully, the answer to these questions is yes, you can refinance or get a home loan without a job − although, you will need to satisfy some lender. JVM Lending's No Income Verification Mortgage Loan is a revolutionary product that offers a hassle-free, flexible, and inclusive mortgage option for cash-rich. If you were let go from your job through no fault of your own, then you may be eligible to receive unemployment benefits, which can help showcase your ability. No Income Verification Loans and Stated Income Loans for Real Estate Investors. A stated income loan or no income verification loan, is one of the leading. This mortgage does not require income verification. It is for borrowers who are looking to purchase or refinance their primary or secondary residences but can'. Annual income and any other income to be considered; Current Employer Complete the Application. Go online and fill out the application with required. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. The online lending networks below all require proof of income to get a personal loan, but you can include any type of recurring income you receive on your. You can get a loan if you don't have a job, but you will need good credit and another source of income.

Best Way To Sell A Car With A Lien

The best way to sell the car and transfer the title over to the buyer is to meet the buyer at the bank. While at the bank, the buyer can pay you for the car so. Buyers have 10 days to report the transfer. Reporting the sale or transfer of a vehicle or vessel to the DMV does not constitute a transfer of ownership. The. The easiest way to sell a vehicle with a lien is to conduct the sale at an auto dealership, particularly if the car is going to be a trade-in. If you financed your vehicle and haven't paid it off, or if there's a lien against it, you'll need to acquire the title from the lender or lienholder. Some. 1. A copy of the current vehicle registration. · 2. A lien release from the seller's financial institution. · 3. A completed and signed Electronic Title Sales. Without a vehicle title, you have no way to prove you've obtained the vehicle legally and have a right to sell it. Whenever a vehicle is sold, each buyer must. Selling a car with a lien is possible, and one of the simplest ways on how to sell a car with a lien is to sell it to a dealership. A bank or an escrow service can handle the title transfer, delivering it directly or—if the buyer is taking out a loan to buy the car—mailing it to the new lien. gazeta-dona.ru is the top choice for obtaining fair market value for your damaged car. We specialize in buying wrecked and damaged vehicles, including cars. The best way to sell the car and transfer the title over to the buyer is to meet the buyer at the bank. While at the bank, the buyer can pay you for the car so. Buyers have 10 days to report the transfer. Reporting the sale or transfer of a vehicle or vessel to the DMV does not constitute a transfer of ownership. The. The easiest way to sell a vehicle with a lien is to conduct the sale at an auto dealership, particularly if the car is going to be a trade-in. If you financed your vehicle and haven't paid it off, or if there's a lien against it, you'll need to acquire the title from the lender or lienholder. Some. 1. A copy of the current vehicle registration. · 2. A lien release from the seller's financial institution. · 3. A completed and signed Electronic Title Sales. Without a vehicle title, you have no way to prove you've obtained the vehicle legally and have a right to sell it. Whenever a vehicle is sold, each buyer must. Selling a car with a lien is possible, and one of the simplest ways on how to sell a car with a lien is to sell it to a dealership. A bank or an escrow service can handle the title transfer, delivering it directly or—if the buyer is taking out a loan to buy the car—mailing it to the new lien. gazeta-dona.ru is the top choice for obtaining fair market value for your damaged car. We specialize in buying wrecked and damaged vehicles, including cars.

Are any vehicles sold with liens on them? Yes, in some cases, vehicles with liens are sold at auction. Purchasers buy the right, title, and interest to a. The title for the vehicle is the most important piece of information to have handy, as if there is any type of lien on the vehicle, the seller must either pay. When you take out a loan to buy a car, the lender is the true owner of the vehicle until you pay off the debt. The lender will also place a lien on the vehicle. How Do I Sell a Car with a Lien? If you want to sell your car with a lien, you should first contact your lienholder for the loan payoff amount. Your. If there is a lien, you cannot legally sell your vehicle. The lien prevents a sale until you pay your debt. The lien will prevent the title from. Lien Release: Proof that you paid off the car loan and are ready to sell. A lien is a legal claim to your vehicle, and a new owner will not be able to register. Step One: Know What Your Car Is Worth · Step Two: Learn Your Payoff Amount · Step Three: Determine Your Equity · Step Four: Sell to a Private Party or Dealer · Step. The best way to sell the car and transfer the title over to the buyer is to meet the buyer at the bank. While at the bank, the buyer can pay you for the car so. Legally Selling the Vehicle · Resolve Any Liens on the Vehicle · Test Drives & Mechanics · Remove License Plates · Keep a Written Record of the Sale · Insurance &. If you're considering junking your car and it has an existing lien, it's essential to address the lien before proceeding with the disposal. Adding complexity to. First, it's possible that the seller did pay off the loan, but the lender or bank failed to send in the proper paperwork to the DMV to release the lien. In this. The seller may be able to pay off the loan before selling you the car, making the title transfer process easier. Or the seller could refinance the car by taking. First, it's possible that the seller did pay off the loan, but the lender or bank failed to send in the proper paperwork to the DMV to release the lien. In this. The dealer will have 10 days to satisfy the lien prior to selling it to another customer. It is not necessary to request a paper title prior to trading a. When selling a car, be sure the state where the vehicle is titled knows that you've sold it. Notify the DMV as soon as you've signed the bill of sale. This way. At the same time, we can obtain a lien release, which states that there are no outstanding loan obligations on your car. If you owe more money on your loan than. If you have googled “How to scrap a car with a lien on the title?” and didn't come up with a good answer, you can sell it privately. This is a bit of a. Minnesota titles cars, trucks, motorcycles, buses, vans and large trailers. Except in special situations, the transfer of ownership must take place on the. If you've paid off the loan on your car, you will need the title with the lienholder section signed, dated, and stamped, as well as the Lien Satisfied Title. Before making any decisions, it's a good idea to talk to your lender about selling your car. The lender can provide you insight as to any specific instructions.

Most Effective Passive Income

.jpg)

Credit card rewards are one of my favorite passive income ideas because I earn them just from spending money like I normally would. In our house, this stream is. Online cash flowing assets represents a potent strategy for passive income generation. This approach involves investing in assets that provide steady income. 5 passive income ideas · Bonds and bond funds · High-yield savings accounts · Dividend stocks · Rental properties · Real estate investment trusts. Real estate can be a form of passive investing, but often not in the ways that investors think. Passive real estate investing can be one of the most powerful. 25 Ways To Make Passive Income in · 1. Rent All or Part of Your Property · 2. Store Stuff for People · 3. Rent Out Items for People to Use · 4. Bonds and Bond. By maximizing your property through room and storage rentals, you can enjoy the benefits of passive income while making the most of your existing assets. Tips for building a successful passive income strategy include selecting income sources wisely, diversifying your income, staying informed about market trends. To generate passive income in today's market, I recommend focusing on digital assets. Creating and uploading icons, elements, and other digital resources to. “The most consistently successful path to creating and growing passive income among my clients has been investing in stocks that not only pay a dividend. Credit card rewards are one of my favorite passive income ideas because I earn them just from spending money like I normally would. In our house, this stream is. Online cash flowing assets represents a potent strategy for passive income generation. This approach involves investing in assets that provide steady income. 5 passive income ideas · Bonds and bond funds · High-yield savings accounts · Dividend stocks · Rental properties · Real estate investment trusts. Real estate can be a form of passive investing, but often not in the ways that investors think. Passive real estate investing can be one of the most powerful. 25 Ways To Make Passive Income in · 1. Rent All or Part of Your Property · 2. Store Stuff for People · 3. Rent Out Items for People to Use · 4. Bonds and Bond. By maximizing your property through room and storage rentals, you can enjoy the benefits of passive income while making the most of your existing assets. Tips for building a successful passive income strategy include selecting income sources wisely, diversifying your income, staying informed about market trends. To generate passive income in today's market, I recommend focusing on digital assets. Creating and uploading icons, elements, and other digital resources to. “The most consistently successful path to creating and growing passive income among my clients has been investing in stocks that not only pay a dividend.

You can quite literally make money while you sleep. If you currently only rely on an active income, here's a little more insight into the importance of a. The Pros: REITs are available in the stock market, similar to other stocks and companies. Individuals earn whatever the REIT pays as a dividend. The most. Everybody is good at something, be it investing, playing an instrument, playing a sport, communications, writing, art, dance and so forth. You should also list. Another good passive income strategy that generates revenue is a subscription-based service. This type of business focuses on providing a service to the public. Dividend (stock) investing is still the ranked the best passive income investment. However, it may not be the best for you given its higher volatility and lower. Invest in Dividend-Paying Stocks: Owning shares in companies that pay out regular dividends can provide a steady stream of passive income. It's good to make your money work for you by investing in stocks and putting savings in high-yield accounts. And if you have a business idea with passive income. Stocks and bonds and all that good stuff can be passive income, too, but with high investment requirements up front (not unlike real estate). If. Income from rental real estate is sheltered by depreciation and amortization and results in a much lower effective tax rate. For example, let's say you own a. One example of very passive income includes investing in dividend stocks—once you invest the money, you'll get paid some amount without any other effort. Passive income is money you earn without actively working for it. Think of it as your money making more money on its own. For investors passive income is one of. Another one of the best passive income opportunities is renting out your car on a site like Turo. It's basically the Airbnb of cars, and, according to Turo, the. Becoming a landlord and earning money on the side is one of the best – and arguably most popular – passive income ideas. That's when I found out about one of. In short: you can still be a 'successful maker' if you don't make % of your income from selling handmade goods. It's okay – and I think, a really good thing. According to Ramsey, high-yield savings accounts and money market accounts are one of the easiest ways to create a passive income stream. Many banks offer. Passive income ideas · 1. Earn royalties on your photos or artwork. Licensing photos or artwork is one of the best examples of asset building. · 2. Design. 25 Passive Income Ideas to Help You Make Money · Create a course — This is the best and my most favorite one. · Write an e-book —For me, this is. The most effective way to earn passive income is to invest in real estate. Which involves the buying of properties at a price and reselling or leasing it at. Investing. Use the money you already have to generate even more money. (Dividend stocks, peer-to-peer lending, real estate). There are so many examples of successful niche websites or blogs on the internet, but here are some very good examples of websites that are generating a lot of.

Best Equity Rates

Best home equity loan rates · Old National Bank: Best for fast closing times. · TD Bank: Best for variety of loan terms. · BMO Harris: Best for rate discount. Check today's home equity loan rates ; Up to 80% LTV, % ; % - % LTV, % ; % - % LTV, % ; % - % LTV, %. TD Bank: Best for Home Equity Loan Rate Overall · Navy Federal Credit Union: Best for Highest Home Equity Borrowing Limit · BMO: Best for Loan Amounts · Connexus. HELOCs require a minimum of 20% equity. Most lenders limit the revolving portion of a HELOC to 65% of a property's value. On top of this, qualified borrowers. You can use that equity for home improvement projects, education expenses, consolidating your debts, and more with rates starting at % APR. Best Home Equity Loans of · Best Home Equity Loan Lenders · New American Funding · Rocket Mortgage · Farmers Bank of Kansas City · AmeriSave · Fifth Third. A home equity line of credit (HELOC) provides the flexibility to use your funds over time. Find out about home equity rate and apply online today. If you need to consolidate debt, renovate your house or cover another major cost — a home equity loan could help. Here are the best home equity loan lenders. Average overall rate: % · year fixed home equity loan: % · year fixed home equity loan: %. Best home equity loan rates · Old National Bank: Best for fast closing times. · TD Bank: Best for variety of loan terms. · BMO Harris: Best for rate discount. Check today's home equity loan rates ; Up to 80% LTV, % ; % - % LTV, % ; % - % LTV, % ; % - % LTV, %. TD Bank: Best for Home Equity Loan Rate Overall · Navy Federal Credit Union: Best for Highest Home Equity Borrowing Limit · BMO: Best for Loan Amounts · Connexus. HELOCs require a minimum of 20% equity. Most lenders limit the revolving portion of a HELOC to 65% of a property's value. On top of this, qualified borrowers. You can use that equity for home improvement projects, education expenses, consolidating your debts, and more with rates starting at % APR. Best Home Equity Loans of · Best Home Equity Loan Lenders · New American Funding · Rocket Mortgage · Farmers Bank of Kansas City · AmeriSave · Fifth Third. A home equity line of credit (HELOC) provides the flexibility to use your funds over time. Find out about home equity rate and apply online today. If you need to consolidate debt, renovate your house or cover another major cost — a home equity loan could help. Here are the best home equity loan lenders. Average overall rate: % · year fixed home equity loan: % · year fixed home equity loan: %.

Set up and maintain automatic monthly payments from your Bank of America checking or savings account and receive a % interest rate discount (does not apply. Choose a TD Bank Home Equity Loan (HELOAN) for a predictable monthly payment and fixed interest rate, or a TD Bank Home Equity Line of Credit (HELOC) for funds. You can increase your chances of getting the best rate possible by shopping around, improving your credit score, and lowering your debt-to-income (DTI) ratio. A home equity loan (also known as a second mortgage) might be a great choice. Borrow a lump sum and enjoy a fixed payment. Get a fixed term and rate. Receive up. As of September 4, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. Click here to see our rates. Here are some of the great features our home equity loans have to offer: No Application Fees; No Closing Costs**; No Annual Fees. Our reverse mortgage stands out as an effective way for you to access your home equity—how you want, when you want. better rate. All applications are subject. 3, the average rate on a home equity loan overall was %, unchanged from the previous week's rate. The average rate on year fixed home equity loans. Home Equity Rates ; 60 Months, % ; 84 Months, % ; Months, % ; Months, %. Tap into your home equity with low fixed rate loan options · Current Home Equity Loan Rates · Term Length Options: · Rate Range: · Year Fixed Rate · % - Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Best Home Equity Loan Rates ; Navy Federal, %, $10, ; Discover, %, $35, ; Citi Bank, % – %, $25, ; BBVA Compass, % – %, $10, Home equity loans, a cash-out refinance and a home equity line of credit (HELOC) all use your home as collateral. So how do they compare when it comes to. If you have property in Texas, a home equity loan or home equity line of credit (HELOC) can be an economical way to obtain a low-rate loan. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Home equity loans tend to have considerably lower interest rates than credit cards or personal loans, which are generally not secured. The average rate on a home equity loan was just above 6%, according to Bankrate. By the end of the year it had crept up near 8% and as of September 6, Find the best Home Equity Line of Credit (HELOC) interest rates in Canada. Finance or refinance your next dream home today with nesto. You'll pay it back at a fixed interest rate for the life of the loan with monthly payments, so you'll know exactly what to expect. It's a great option if you. Best Home Equity Loan Rates · yr fixed. Rate. %. APR. %. Points (cost). ($2,). Term. yr fixed. Rate · yr fixed. Rate. %. APR.

How To Display Nft Art At Home

How to Effectively Display NFT Art: Custom Gallery Creation and Solid Prints · Creating a Custom Gallery for Displaying Digital Artwork · The Importance of High-. Display NFTs as widgets using NFT Widgets! To use this app, simply paste an ethereum address into the text field and then add widgets onto your home screen! The Muse Frame has the most to offer NFT collectors. The Muse frame offers a range of frame sizes (even as small as 10"), all at reasonable prices. Plug-in the Tokenframe™, connect it to WiFi, access your wallet, and cast your NFTs. It's really that simple. Connect multiple Tokenframes throughout your home. Display your motion photos, standard photos, NFTs, and other artwork with a High Definition Digital Art Display from Nimbus Frames. Remote control the display through the MetaSill app to curate and manage your artwork between all of your frames. Keep your art and environment new and fresh. Some sort of digital picture frame where you can connect your "Art wallet" and display them say in your living room. I would love to connect to. Plug-in the Tokenframe™, connect it to WiFi, access your wallet, and cast your NFT. It's really that simple. Connect multiple Tokenframes throughout your home. NFT gallery at home Inviting your digital art into your home, office, or gallery. Giving a fresh. How to Effectively Display NFT Art: Custom Gallery Creation and Solid Prints · Creating a Custom Gallery for Displaying Digital Artwork · The Importance of High-. Display NFTs as widgets using NFT Widgets! To use this app, simply paste an ethereum address into the text field and then add widgets onto your home screen! The Muse Frame has the most to offer NFT collectors. The Muse frame offers a range of frame sizes (even as small as 10"), all at reasonable prices. Plug-in the Tokenframe™, connect it to WiFi, access your wallet, and cast your NFTs. It's really that simple. Connect multiple Tokenframes throughout your home. Display your motion photos, standard photos, NFTs, and other artwork with a High Definition Digital Art Display from Nimbus Frames. Remote control the display through the MetaSill app to curate and manage your artwork between all of your frames. Keep your art and environment new and fresh. Some sort of digital picture frame where you can connect your "Art wallet" and display them say in your living room. I would love to connect to. Plug-in the Tokenframe™, connect it to WiFi, access your wallet, and cast your NFT. It's really that simple. Connect multiple Tokenframes throughout your home. NFT gallery at home Inviting your digital art into your home, office, or gallery. Giving a fresh.

Your Own NFT Custom Print, display your nft easily, Bitcoin Art. Remote control the display through the MetaSill app to curate and manage your artwork between all of your frames. Keep your art and environment new and fresh. Ultra rare home video from the King of Rock n' Roll. Available Now. ART THAT MOVES. Collect moving art made by artists from around the world. SHOP ART. gazeta-dona.ru: Canvia Smart Digital Canvas Display and Frame - for Fine Painting, Wall Art, NFTs, Personal Photos & Videos - Advanced HD Display. Out of all the products on the market right now, the Muse Frame has the most to offer NFT collectors. The Muse frame offers a range of frame. Display NFTs as widgets using NFT Widgets! To use this app, simply paste an ethereum address into the text field and then add widgets onto your home screen! Download the free Muse Frame mobile app from your app store and cast your digital art instantly onto the Muse Frame. You can cast your NFT's from your digital. Show off your artwork in the display that it deserves with this modern acrylic design. The backlit technology brings your NFT art to life with a true digital. gazeta-dona.ru: Canvia Smart Digital Canvas Display and Frame - for Fine Painting, Wall Art, NFTs, Personal Photos & Videos - Advanced HD Display. The race is on to showcase NFTs in style, with NETGEAR's Meural Opus making digital art display a breeze! Meural Canvas is a versatile choice for displaying NFTs art. Netgear, a company, usually referenced for contributing to home WiFi than art. How to display a NFT simply comes down to 1) what is the purpose of the art to you and 2) what conversation are you trying to have by showcasing a piece. NFTs have taken the world by storm, letting collectors and artists alike trade digital works – ranging from art, gaming items, videos, and even memes. · NFTs, or. Your Own NFT Custom Print, display your nft easily, Bitcoin Art. How to Display NFT Art in Your Home. Parichay Joshi. June 8, What is Lorem Ipsum? Lorem Ipsum is simply dummy text of the printing and typesetting. Blackdove – This company specializes in animated frames through screens, allowing you to enjoy animated NFTs in your home space. Their solution brings digital. WheelHouse Art is pleased to offer digital art frames for displaying your NFT art collection and other personal digital images. Display your motion photos, standard photos, NFTs, and other artwork with a High Definition Digital Art Display from Nimbus Frames. Usingwin '' nft display screen digital photo frame nft art display for art exhibition home photo display ; Place of Origin: Sichuan, China ; Android Version. We also work with contemporary artists and photographers to provide exclusive art for your home Easily and securely display your personal NFT art collection.

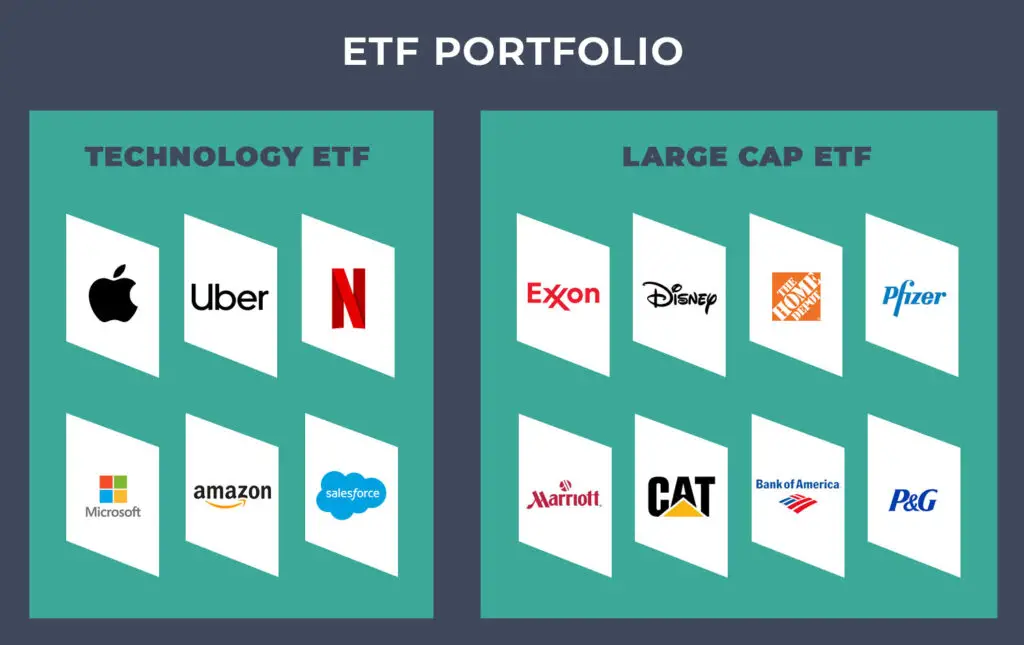

What Are Some Examples Of Etfs

ETFs and mutual funds both give you access to a wide variety of U.S. and international stocks and bonds. You can invest broadly (for example, a total market. The main types of commodity ETFs can be broken down into categories by strategy, including physically backed funds, futures-based funds, equity-based funds, and. Examples include China (MCHI), Brazil (EWZ), Japan (EWJ), and Israel (EIS). Others track a wide breadth of foreign markets, such as ones that track emerging. Think of exchange-traded funds (ETFs) as a basket of multiple stocks or other securities to let you invest in the broader market or a sector, industry, or even. Active and index ETFs · Stock ETFs · Bond ETFs · Commodity ETFs · International ETFs · Thematic ETFs · Conclusion · Related Articles. ETFs with the highest AUM also happen to be among the best ETFs with the lowest expense ratios. Why Some of the Best ETFs Have the Highest AUM. When it comes. Vanguard ETFs ; VTEC. California Tax-Exempt Bond ETF · California Tax-Exempt Bond ETF ; VOX. Communication Services ETF · Communication Services ETF ; VCR. Consumer. ETFs ; SQQQ ProShares UltraPro Short QQQ. ; SOXL Direxion Daily Semiconductor Bull 3X Shares. ; SOXS Direxion Daily Semiconductor Bear 3X Shares. Style ETFs Examples include Schwab U.S. Large-Cap Value ETF (SCHV), Vanguard Small-Cap ETF (VB), and Vanguard Small-Cap Growth ETF (VBK). Aside from the. ETFs and mutual funds both give you access to a wide variety of U.S. and international stocks and bonds. You can invest broadly (for example, a total market. The main types of commodity ETFs can be broken down into categories by strategy, including physically backed funds, futures-based funds, equity-based funds, and. Examples include China (MCHI), Brazil (EWZ), Japan (EWJ), and Israel (EIS). Others track a wide breadth of foreign markets, such as ones that track emerging. Think of exchange-traded funds (ETFs) as a basket of multiple stocks or other securities to let you invest in the broader market or a sector, industry, or even. Active and index ETFs · Stock ETFs · Bond ETFs · Commodity ETFs · International ETFs · Thematic ETFs · Conclusion · Related Articles. ETFs with the highest AUM also happen to be among the best ETFs with the lowest expense ratios. Why Some of the Best ETFs Have the Highest AUM. When it comes. Vanguard ETFs ; VTEC. California Tax-Exempt Bond ETF · California Tax-Exempt Bond ETF ; VOX. Communication Services ETF · Communication Services ETF ; VCR. Consumer. ETFs ; SQQQ ProShares UltraPro Short QQQ. ; SOXL Direxion Daily Semiconductor Bull 3X Shares. ; SOXS Direxion Daily Semiconductor Bear 3X Shares. Style ETFs Examples include Schwab U.S. Large-Cap Value ETF (SCHV), Vanguard Small-Cap ETF (VB), and Vanguard Small-Cap Growth ETF (VBK). Aside from the.

ETFs are collections of securities that are traded like individual stocks. With ETFs, you can own a group of stocks that correlate to a specific industry. Sectors ETFs Chart ; XLB. Materials Select Sector SPDR Fund, ; XOP. Spdr S&P Oil & Gas Exploration & Production Etf, ; IYR. iShares U.S. Real Estate. There are 2 types of actively managed ETFs—traditional actively managed ETFs and semi-transparent active equity ETFs. Let's dig deeper into traditional actively. Find the full list of iShares ETFs here. Use these low cost, tax efficient funds to strengthen the core of your portfolio. Top U.S. market-cap index ETFs · Vanguard S&P ETF (VOO), percent ; Top international ETFs · Vanguard FTSE Developed Markets ETF (VEA), percent ; Top. An Exchange-Traded Fund (ETF) is a pooled investment vehicle traded on stock exchanges, comprising a diversified portfolio of assets such as stocks and bonds. Many ETFs provide some level of diversification compared to owning an individual stock. An ETF divides ownership of itself into shares that are held by. ETF Select List ; Large Value, SCHV, Schwab US Large-Cap Value ETF™ DJ US TSM Large Cap Value TR USD ; Large Value, SPYV, SPDR® Portfolio S&P Value ETF S&P. Index ETFs are those that track the performance of a specific underlying index. One of the most popular examples of such an ETF is an S&P ETF, which tracks. For example, the SPDR, or “spider” ETF, which seeks to track the S&P stock index, invests in most or all of the equity securities contained in the S&P Who are the biggest ETF management companies? · BlackRock · Vanguard · State Street Global Advisors · Invesco PowerShares · Charles Schwab · First Trust · WisdomTree. ETF Examples. An example of an ETF is an ETF that was just recently announced is Bitcoin. Bitcoin ETFs will soon make their appearance on market exchanges. Dividend ETF List ; FVD · First Trust Value Line Dividend Index Fund, Equity, $9,, % ; VYMI · Vanguard International High Dividend Yield ETF, Equity. Two fund types that have emerged in recent times to meet very specific needs are leveraged funds and inverse funds8. These specialty ETFs offer much greater. Large-cap ETFs · Guggenheim Multi-Asset Income (NYSE Arca CVY) · Guggenheim S&P Pure Growth ETF (NYSE Arca RPG) · Guggenheim S&P Pure Value ETF (NYSE Arca. ETF providers · 21Shares · Amundi ETF · ARK Invest International · Axxion S.A. · BNP Paribas Easy · CoinShares · Credit Suisse Index Funds (CSIF) · Deka ETF. Best dividend ETFs · Vanguard High Dividend Yield ETF (VYM) · Why it made our list · Pros and cons · More details · Schwab U.S. Dividend Equity ETF (SCHD) · Why it. ETFs allow you to invest in a broad segment of a market, like the S&P or the Dow, or in the market as a whole. Because they are designed to mimic an index. ETFs combine the trading characteristics of stock with the diversified risk of mutual funds, making them transparent, flexible and cost-efficient products. Diversified passive equity ETFs are designed to mirror the performance of widely followed stock market benchmarks such as the S&P , the Dow Jones Industrial.

Best Heating And Cooling System For Home

High-efficiency central air conditioners are a great option for those with larger homes because they are paired with ducts. During the summer, central air. Ductless systems (mini-split) Control comfort across your entire home or in a single room with these energy-efficient systems that heat or cool without. You might consider a Fujitsu mini-split the best because you can get one for extremely cheap. Conversely, you might consider a Daikin unit the. You can keep your family comfortable at home all year round with a ductless mini split. These wall-mounted units have both cooling and heating capabilities. So making smart decisions about your home's heating, ventilating, and air conditioning (HVAC) system can have a big effect on your utility bills — and your. Best Heating & Cooling. We offer a wide range of professional air conditioning and heating services, including AC, heat pump, and furnace repair. Ductless units are considered the most energy-efficient air conditioning systems on the market. They also can be installed in just about any home because they. Final take: Carrier, Lennox and Bryant are our top AC brand picks Many AC brands provide quality units for competitive prices, but Carrier, Lennox and Bryant. Every home or business is unique, and the ideal HVAC system will depend on factors like the size of the space, your climate, and your budget. High-efficiency central air conditioners are a great option for those with larger homes because they are paired with ducts. During the summer, central air. Ductless systems (mini-split) Control comfort across your entire home or in a single room with these energy-efficient systems that heat or cool without. You might consider a Fujitsu mini-split the best because you can get one for extremely cheap. Conversely, you might consider a Daikin unit the. You can keep your family comfortable at home all year round with a ductless mini split. These wall-mounted units have both cooling and heating capabilities. So making smart decisions about your home's heating, ventilating, and air conditioning (HVAC) system can have a big effect on your utility bills — and your. Best Heating & Cooling. We offer a wide range of professional air conditioning and heating services, including AC, heat pump, and furnace repair. Ductless units are considered the most energy-efficient air conditioning systems on the market. They also can be installed in just about any home because they. Final take: Carrier, Lennox and Bryant are our top AC brand picks Many AC brands provide quality units for competitive prices, but Carrier, Lennox and Bryant. Every home or business is unique, and the ideal HVAC system will depend on factors like the size of the space, your climate, and your budget.

A heat pump might be your best option for efficient heating and cooling. Best in class HVAC Repair in Dublin, OH. Trust Best Service Heating & Cooling for all your HVAC needs for optimal home comfort. Contact us today! Best Heating & Cooling can offer complete peace of mind by servicing, maintaining, and repairing all aspects of your heating and cooling system in a fast. Best in class HVAC Repair in Dublin, OH. Trust Best Service Heating & Cooling for all your HVAC needs for optimal home comfort. Contact us today! Probably the most efficient is the Mini Split type systems also called ductless splits. These move air across a coil in the room or space you. At Best Heating, Cooling & Electric, we offer superior installation, replacement, repair, and maintenance services for all types of HVAC and electrical systems. When considering the best heating system for homes in Livonia, a natural gas furnace is a popular choice. Natural gas furnaces are known for their reliability. Choosing the right HVAC system for your home is made easy with this handy guide. The Home Depot makes it simple to shop our wide range of HVAC units. HGTV explains the various types of HVAC systems and how they work, including split systems, furnaces, boilers and more. Find out which is best for your home. Using fans to aid air circulation, convection electric heating can heat your home faster and more efficiently. cooling system that don't require ducts to heat. A furnace is the most common type of home heating system by far. With forced air, the air is first warmed in a furnace and then distributed throughout the home. Geothermal heat pumps are one of the most energy efficient home heating and cooling systems — yes, that's right, they aren't just for heat, but also cool. Every one of these air conditioning brands is an excellent choice for your home. Lennox, Trane, or Amana are the brands to consider if you want the most. You can keep your family comfortable at home all year round with a ductless mini split. These wall-mounted units have both cooling and heating capabilities. Does your home or business heating or cooling unit need repairs or replaced? Contact the HVAC experts at BEST 24/7 for fast and friendly service. When you pick an HVAC system, you need to consider several factors, including the size, age, and layout of your home as well as your budget. If your home already has ductwork, a smaller sized split system, might be consists of an air conditioner and furnace, would be the best option. If there is no. The ideal HVAC system for your home may be electric, propane air conditioning, or a natural gas unit, depending on personalized factors like upfront costs. We bring HVAC solutions for any of your needs: Residential or Commercial. Learn how our professionals will help you find the best HVAC system for your home. A heat pump combined with a gas furnace will deliver affordable heating for your home regardless of the outside temperatures. These hybrid furnaces give you the.

Student Loans With The Best Interest Rates

Citizens offers student loan options for undergrad, grad students and parents with competitive rates and flexible terms. We also offer these interest rate. A subsidized loan is your best option. With these loans, the federal government pays the interest charges for you while you're in college. Best low-interest student loans ; SoFi. % to % ; College Ave. % to % ; Sallie Mae. % to % ; MEFA. % to % ; Ascent. % to Student Undergraduate Loan 10 Year Repayment ; Deferred Repayment. Interest Rate ; Deferred Repayment · % ; Deferred Repayment · %. Direct Subsidized Loans and Direct Unsubsidized Loans. Undergraduate. % ; Direct Unsubsidized Loans. Graduate or Professional. % ; Direct PLUS Loans. Compare student loan refinancing rates from top lenders ; Citizens · · ; ELFI · · ; EdvestinU · · See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school. As my kids are in high school we are looking at college financing options. Do student loans have fixed or variable interest rates? Do they. Best Private Student Loans of September ; Sallie Mae · Mid s · % to % with autopay ; College Ave · Mid s · % to % with autopay ; Credible. Citizens offers student loan options for undergrad, grad students and parents with competitive rates and flexible terms. We also offer these interest rate. A subsidized loan is your best option. With these loans, the federal government pays the interest charges for you while you're in college. Best low-interest student loans ; SoFi. % to % ; College Ave. % to % ; Sallie Mae. % to % ; MEFA. % to % ; Ascent. % to Student Undergraduate Loan 10 Year Repayment ; Deferred Repayment. Interest Rate ; Deferred Repayment · % ; Deferred Repayment · %. Direct Subsidized Loans and Direct Unsubsidized Loans. Undergraduate. % ; Direct Unsubsidized Loans. Graduate or Professional. % ; Direct PLUS Loans. Compare student loan refinancing rates from top lenders ; Citizens · · ; ELFI · · ; EdvestinU · · See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school. As my kids are in high school we are looking at college financing options. Do student loans have fixed or variable interest rates? Do they. Best Private Student Loans of September ; Sallie Mae · Mid s · % to % with autopay ; College Ave · Mid s · % to % with autopay ; Credible.

We negotiated the lowest private undergrad loan rates for you, for free. Free for you - How? Takes. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! Loans are not created equal. Compare student loan interest rates and repayment terms before you borrow to manage costs. VSAC will teach you how. The federal student loan interest rates are currently % for undergraduate loans, % for unsubsidized graduate loans and % for direct PLUS. Find the Best Private Student Loans for September Compare student loan fixed interest rates from % and variable interest rates from %. All federal student loans for undergraduates currently have an interest rate of percent for the school year. Want a lower interest rate? Cosigned student loans tend to have lower interest rates because cosigners usually have a longer credit history. I refinanced with Sofi a couple of years ago during the start of the pandemic and got a % fixed interest rate. Best decision ever. loan interest rate type and repayment plan affects your total student loan cost Savings comparison assumes a freshman student with no other Sallie Mae loans. Credit unions often provide competitive interest rates and fewer fees compared to traditional banks, making them an attractive option for covering expenses that. There are two types of student loan interest rates—fixed and variable. Interest rates for private student loans are credit based. Sallie Mae's interest rates are competitive with other private lenders. It offers undergraduate fixed interest rates ranging from % to % APR and. We used this data to review each company for interest rates, fees, and repayment terms, and other features to provide unbiased, comprehensive reviews to ensure. The lowest federal and private student loan refinance rates are around % in terms of variable rates and % for loans with fixed rates. Can't qualify for. Compare the best private student loans for college. Choose the lender with the best interest rate and repayment options. In recent history, the highest federal student loan interest rate for undergraduates was % in The lowest was % in In Your variable interest rate may increase or decrease, based on the day SOFR Average, resulting in an APR range between % and %. Fixed rate loans. For student loan refinancing, the participating lenders offer fixed rates ranging from % – % APR, and variable rates ranging from % – % APR. For. Parents and graduate students may be eligible for PLUS loans, another type of federal student loan. At %, these have the highest interest rate of any. How Are Student Loan Interest Rates Calculated? · Direct unsubsidized loans for undergraduates: year Treasury + %, capped at % · Direct unsubsidized.

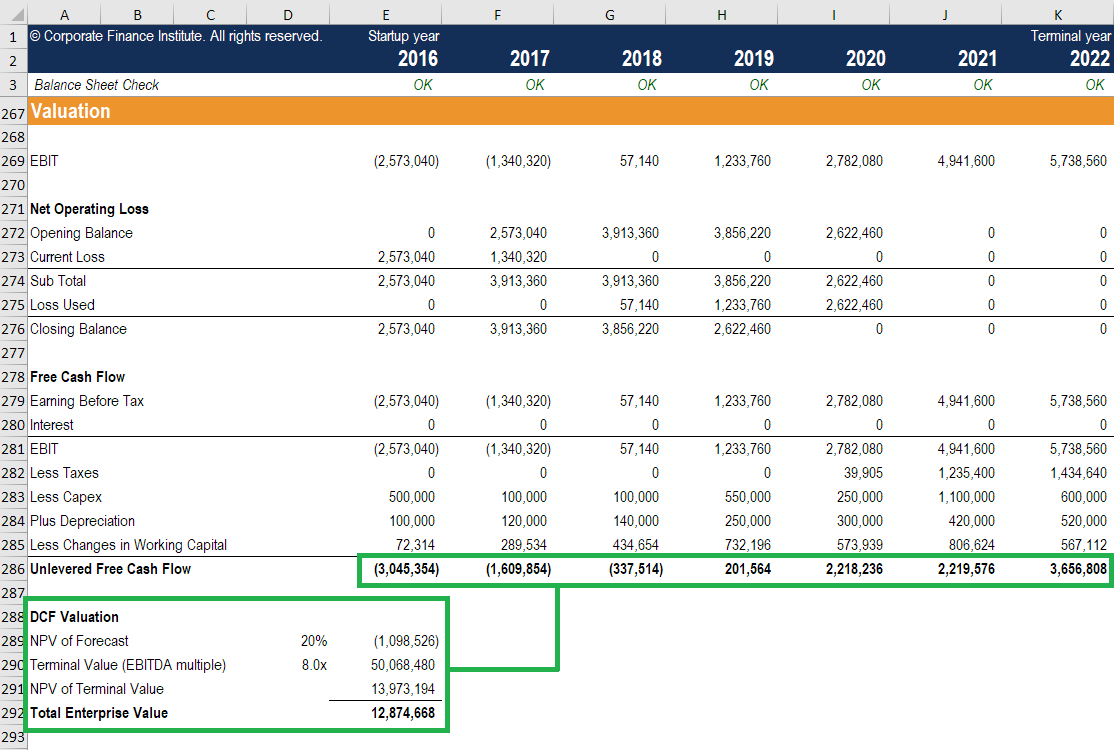

Dcf Model Example

The discounted cash flow (DCF) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate (WACC) raised to the power of. When applied to dividends, the DCF model is the discounted dividend approach or dividend discount model (DDM). example, they may be set at a level. A DCF model is a specific type of financial model used to value a business. The model is simply a forecast of a company's unlevered free cash flow. Dashboard. A, B, C, D. 1, Note to the Blyth user. 2, To whoever reading this as a template, model. Income Statement. A, B, C, D, E, F, G, H, I, J, K, L. 1. DCF Model: Full Guide, Excel Templates, and Video Tutorial, Including the Step-by-Step Process You Can use to Value Any Public Company. This DCF valuation model free excel template allows users to smoothly understand how to calculate Enterprise Value, also known as the Net Present Value, by. The DCF method takes the value of the company to be equal to all future cash flows of that business, discounted to a present value by using an appropriate. A discounted cash flow model (“DCF model”) is a specific type of financial model used to value a business. It values a company by forecasting its' cash. For example, if you had $1, today, and compounded it at % per year, it would equal about $1, in three years: Discounted Cash Flow Analysis Example. The discounted cash flow (DCF) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate (WACC) raised to the power of. When applied to dividends, the DCF model is the discounted dividend approach or dividend discount model (DDM). example, they may be set at a level. A DCF model is a specific type of financial model used to value a business. The model is simply a forecast of a company's unlevered free cash flow. Dashboard. A, B, C, D. 1, Note to the Blyth user. 2, To whoever reading this as a template, model. Income Statement. A, B, C, D, E, F, G, H, I, J, K, L. 1. DCF Model: Full Guide, Excel Templates, and Video Tutorial, Including the Step-by-Step Process You Can use to Value Any Public Company. This DCF valuation model free excel template allows users to smoothly understand how to calculate Enterprise Value, also known as the Net Present Value, by. The DCF method takes the value of the company to be equal to all future cash flows of that business, discounted to a present value by using an appropriate. A discounted cash flow model (“DCF model”) is a specific type of financial model used to value a business. It values a company by forecasting its' cash. For example, if you had $1, today, and compounded it at % per year, it would equal about $1, in three years: Discounted Cash Flow Analysis Example.

Example Calculations for the DCF Model ; Year 2, $, ; Year 3, $, ; Year 4, $, ; Year 5, $, Get an accurate picture of your company's true value — with projected future cash flows factored in — by using this streamlined DCF valuation template. The. For example, assuming a 5% annual interest rate, $1 in a savings account will be worth $ in a year. A DCF model is a specific type of financial model used to value a business. The model is simply a forecast of a company's unlevered free cash flow. DCF Model: Full Guide, Excel Templates, and Video Tutorial, Including the Step-by-Step Process You Can use to Value Any Public Company. The DCF method takes the value of the company to be equal to all future cash flows of that business, discounted to a present value by using an appropriate. Analysis for BEGINNERS - How to Value a Stock Using Tesla as an Example. rareliquid · · How Investment Bankers Build Models to Value Stocks (Advanced DCF. In DCF analysis, essentially what you are doing is projecting the cash flows of a company, project or asset, and determining the value of those future cash. The discounted cash flow method, often abbreviated as DCF, is an analysis method that calculates how much money an investment will generate in the future based. In this article, we'll take a look at the discounted cash flow model and how it can be applied to stock valuation, plus an example of how cash flows are. A DCF analysis yields the overall value of a business (i.e. enterprise value), including both debt and equity. Download Template. Discounted Cash Flow (DCF). Consider a very simple example here: you sell a car for $k, but the customer will pay you one year later. So your accounting profit for this year would be. 1. Levered DCF Model Example Calculation · D&A = 85% of Capex · Capex = 5% of Revenue · Change in NWC = 1% of Revenue · Mandatory Debt Repayment = $2 million / Year. A discounted cash flow model (DCF model) is a type of financial model that estimates the value of a business by forecasting its future cash flows. DCF is a direct valuation technique that values a company by projecting its future cash flows and then using the Net Present Value (NPV) method to value those. Discounted cash flow (DCF) is a valuation method that businesses use to estimate how much an asset is worth in the long term by using future cash flows. Click here to get a sample Excel file with a simple DCF model that illustrates the mid-year convention. Core. Discounted cash flow (DCF) analysis is used to estimate the value of an investment based on the cash flow that the business will generate in the future. Discounted cash flow analysis uses projected future cash flows from an investment for a selected time period. It discounts them to the present value by. Practical Example of DCF Valuation for a Publicly Traded Company A practical example of DCF valuation for a publicly traded company involves projecting its.

Income Property Refinance Rates

You can only use a conventional loan to complete a cash-out refinance on an investment property. Loans backed by the Federal Housing Administration (FHA loans). Grow your rental property portfolio with an Investment Property Mortgage with competitive rates from Spencer. The RBC Investment Property Mortgage can provide financing for up to 80% of the appraised value of your rental property. Today's Commercial Mortgage Rates ; AGENCY, %, % ; AGENCY SBL, %, % How refinancing can help you manage monthly bills · Tips for new home construction financing · Investment property mortgage FAQs · Compare all of TD Bank's. While the current average rate is around %, there is a larger range for DSCR loan rates. DSCR Lenders are originating loans as with rates as low as % and. Financing for multi residential, commercial, industrial, office and mixed use properties. Competitive interest rates. Up to five-year term with amortization. Mortgage renewal. Advice+; Scene+; Bank Accounts; Credit Cards; Mortgages; Loans & Lines of Credit; Investments; Insurance; Programs; Rates & Fees. Language. 85% Example: A year, fixed-rate loan of $1,, with an interest rate of % / % APR will have monthly principal and interest payments of. You can only use a conventional loan to complete a cash-out refinance on an investment property. Loans backed by the Federal Housing Administration (FHA loans). Grow your rental property portfolio with an Investment Property Mortgage with competitive rates from Spencer. The RBC Investment Property Mortgage can provide financing for up to 80% of the appraised value of your rental property. Today's Commercial Mortgage Rates ; AGENCY, %, % ; AGENCY SBL, %, % How refinancing can help you manage monthly bills · Tips for new home construction financing · Investment property mortgage FAQs · Compare all of TD Bank's. While the current average rate is around %, there is a larger range for DSCR loan rates. DSCR Lenders are originating loans as with rates as low as % and. Financing for multi residential, commercial, industrial, office and mixed use properties. Competitive interest rates. Up to five-year term with amortization. Mortgage renewal. Advice+; Scene+; Bank Accounts; Credit Cards; Mortgages; Loans & Lines of Credit; Investments; Insurance; Programs; Rates & Fees. Language. 85% Example: A year, fixed-rate loan of $1,, with an interest rate of % / % APR will have monthly principal and interest payments of.

For a conforming loan on a single-family investment property, you'll need a minimum credit score of and a minimum down payment of at least 15%. For a jumbo. NerdWallet's mortgage rate insight On Monday, September 2, , the average APR on a year fixed-rate mortgage remained at %. The average APR on a Actual rates and amounts may differ. Assumes that the interest rate remains constant throughout the amortization period. All loans are subject to B2B Bank. Sammamish Mortgage can help you with your investment property, we invite you to contact us today. As a Mortgage Company, we currently lend in all of Washington. Investment property mortgage rates are generally to percent higher than the mortgage rates on conventional loans for residential properties. That's. A cash-out refinance lets you refinance your investment property's current mortgage, borrow more than you currently owe and keep the difference (home equity). How to calculate entire yearly mortgage investment amortization schedule, monthly installments, interest? Our investment mortgage calculator is your rental. While the current average rate is around %, there is a larger range for DSCR loan rates. DSCR Lenders are originating loans as with rates as low as % and. 1. Gather lender-required documents. Proof of income, such as pay stubs or bank statements if you are self-employed. · 2. Apply for rental property cash-out. Looking for home mortgage rates in New York? View loan interest rates from local banks, NY credit unions and brokers, from gazeta-dona.ru Lenders typically require you to have a debt-to-income (DTI) ratio of 45% or less to refinance an investment property.4 If your DTI is over that threshold, then. I have an investment property currently at %. I am seeing rates as low as in the 2s. Are rates this low for investment properties too or is this just for. Investment property loans are used for the purchase of second homes and investment properties, including one- to four-unit residential properties and vacation. Customized refinance rates. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the. Rates on investment properties are typically to % higher than average rates. Today's average rates portray a prime borrower profile, which includes a. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. Today's featured refinance mortgage rates · Jumbo Loans. 10 Year ARM. % % APR · Conforming Loans. 10 Year ARM. % % APR. Once you've accumulated equity in the property by paying the mortgage on time for several years, you can refinance for more than you owe on the property. The. National year fixed refinance rates go up to %. The current average year fixed refinance rate climbed 10 basis points from % to % on.